It is all too tempting to judge an economy’s health simply by its growth rate. No big wonder then that many economic policies are devised with growth as their only goal. However, this approach grossly simplifies the complexity of an economy’s inner workings. Rather than searching for the one perfect signal of economic success, I suggest to take the opposite angle: trying to understand what could go wrong. A comprehensive review of the different ways an economy can fail should become the starting point for projecting a more nuanced picture of economic health, and for developing more realistic policies.

In a previous post, I presented a rough concept of how we could frame such a more realistic picture. Today, I’ll offer a more detailed sketch of this concept. The following charts illustrate how our own economic narrow-mindedness makes us susceptible to economic failure, i.e., how a singular focus on growth blinds us for many important aspects of economic health. So let’s see how much we are usually unaware of, how much remains hidden under the surface of everyday economic debate.

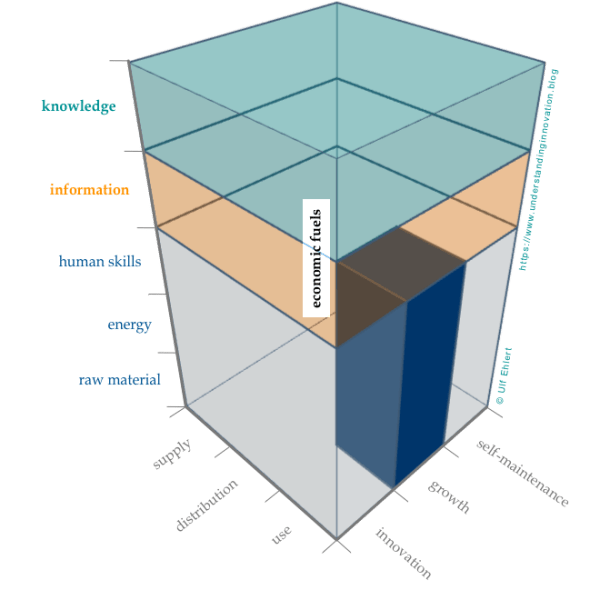

This chart depicts an economy as a three-dimensional space, along three axes: economic processes, economic fuels, and innovation targets. In this abstract economic space, the narrow focus on economic expansion is represented by the use of raw material, energy, and human skills for economic growth. That contains just one fifteenth of the entire space (three of the 45 blocks); and even though these blocks are not designed for equal size, it is obvious that the growth focus ignores the vast majority of the economic space. To give you an idea of how much we are unaware of, how much we do not take into consideration when devising economic policies, I’ll walk you through the three axes of this economic space one by one.

The economic processes

To get a comprehensive perspective of how an economy works, Jane Jacobs offers invaluable insights in her seminal work on ‘The Nature of Economies’. Drawing analogies from biology and natural systems, she describes an economy is a complex adaptive system that essentially runs on three main processes: growth, innovation, and self-maintenance.

Growth – or ‘expansion’ in Jacobs’ words – is what we usually expect from an economy: it should expand over time. But the comparison with living organisms should remind us that growth is not unlimited: it has a beginning, it is subject to constraints, and it usually has an end. The reasons for these limitations of growth can be found in the other two processes Jacobs describes: innovation and self-maintenance.

Innovation is the process by which an economy responds to challenges and adapts to change (Jacobs talks about ‘development’). Innovation has long been considered an externality, as something ‘happening’ outside the economic space. And at the same time, it was expected to miraculously deliver novel problem-solutions to the economy when they were needed (as you’ll agree, that was not at all a coherent view). Today, innovation is widely understood as a driver for future growth, especially in the long-term. Still, innovation is not a magic wand; it doesn’t obey to orders either; and often it progresses frustratingly slow. All that stems from a key characteristic of innovation: path-dependence. Innovation works with pre-existing components, their recombination and their gradual adjustment. Hence we cannot simply ‘jump’ to a better place, we need to move forward ‘based on what we already have’. That reality asks for patience, and it often demands for step-wise approaches, as the story of iPod and iPhone reminds us.

Self-maintenance is what keeps an economy going. And usually, this process escapes our attention, it happens under the hood, out of sight. Jacobs explains that an economy uses some of its resources to run its basic functions. And importantly, an economy must have the appropriate equipment to work with the available resources. You can see the equivalent at work in your own body: you breathe and eat and drink to take up the resources required to maintain your body, but you are not equipped to breathe methane, eat stones, or drink sea water. So you’ll look for an environment that directly provides the required resources in the shape that you can easily use. And if such a Garden of Eden is beyond your reach, you’ll try to transform easily available resources into a useable shape, for example by desalinating sea water in order to obtain potable water. Obviously, such transformation will cost you some of the resources you have.

Expanding beyond Jacobs’ ideas, I would add three objectives to this self-maintenance process: (1) it should define the rules of the game and the appropriate institutions to oversee them, both economically and politically; (2) it should ensure that public goods are provided, including for example infrastructure, health care, and education; (3) and it should promote the preservation of the economy’s habitat, which includes other economies, trade partners, or political actors, as well as the natural environment.

As Jacobs points out, all three economic processes occur in parallel in a delicate balance, depending on ever-changing circumstances. These processes are interconnected, and they compete for the limited resources available to the economy. A singular focus on growth, especially on short-term growth, clearly risks the health of an economy: ignoring innovation would erode an economy’s ability to adapt to change, but the detrimental effects would become visible only in the medium- to long-term; ignoring self-maintenance would deny an economy the resources required to maintain its basic functionalities, and the consequences could manifest rather quickly (as illustrated by the recent tax-cutting experiment in Kansas).

Against the backdrop of the economic processes, let’s now turn to the second axis of the economic space: the economic fuels.

The economic fuels

Implicit to Jacobs’ description of the nature of economies is the concept of the resources that drive the economic processes. That’s what I’ll call economic fuels.

Conventional policies focus on raw material, the basic ‘building blocks’ of our world, and on energy, which is indispensable for transporting and transforming raw material. Add human skills, i.e., a sufficiently trained and numerous workforce, and you have all that’s required to shape the world according to our needs and desires. Don’t you? Well, yes … as long as you are content with what I would call a physical economy: the type of economy that slowly evolved over many generations of humankind; the type of economy that is largely visible and tangible. But what about the emerging information and knowledge economies and their promise of future growth? These are comparatively fresh concepts, hence the applicability of traditional growth policies is not to be taken for granted.

I view information and knowledge as two economic fuels that we don’t yet fully comprehend. On one hand: Yes – they do have solid roots in the physical economy. And on the other hand: No – they don’t simply work in the same way as raw material, energy, or human skills. But what’s the difference really? It’s in the characteristics of these resources.

- Raw material, energy, and human skills (let’s call them ‘physical resources‘) are rival resources: you can only use them for one purpose at a time. All three are excludable: if you have them, I cannot use them. In addition, raw material and energy are depletable: use them once and they are gone. Plus: the transportation of raw material, of many primary energy carriers, and of humans (the ‘carriers’ of human skill) is time-consuming and costly. Therefore, these resources, which have been the drivers of the physical economy so far, promote ideas of competition, ownership and control, they encourage hoarding, and they are the root cause of most of our sustainability challenges.

- As non-physical resources, information and knowledge show distinctly different characteristics. They are non-rival and non-excludable: you can use them for multiple purposes, and share them with multiple users, all at the same time. They are non-depletable, so you can re-use them at will. Their instantaneous transmission occurs without delay and at negligible cost. And finally, you can easily copy them make them available to as many beneficiaries as you’d like. As the old adage goes: ‘knowledge is the only resource that grows with use’. Therefore, knowledge could be seen as the ideal fuel for a perpetual motion machine.

If you then look at the conventional growth policies for a physical economy, you’ll find that they predominantly regulate ownership of and access to resources. And since the 1980s, they have increasingly promoted their efficient use, seeking to reduce the waste of scarce resources. Granted, these are sensible policies for rival, excludable resources. However, such policies are futile when it comes to promoting the further development of information and knowledge economies, due to the fundamentally different characteristics of the non-physical resources driving those types of economies. As non-rival, non-excludable resources, information and knowledge defy traditional economic wisdom, they don’t comply with a simplistic logic that views economic competition as a zero-sum game. The rivalry over exclusive access to or ownership of resources that dominated our thinking in the physical economy does not guarantee success in the emerging information and knowledge economies. Instead, the speed of access, the diversity of sources, the context of use, and our creativity in making use of these resources become increasingly decisive.

Under these conditions, a static end-state is neither achievable nor desirable. These new types of economies will be in a state of flux, subject to slower or faster change, constantly evolving and adapting to ever-changing circumstances. Economic strength then is not characterized by robustness or resistance to change, i.e., the ability to withstand any crisis and to remain unchanged. On the contrary, strength in an information or knowledge economy will arise from adaptability and resilience, from the ability to respond to change, to bounce back after crisis, and to adjust appropriately. The pace of such types of economies will seem breathless, relentless, even merciless – at least in comparison to ancient times when the grandparents’ experience still offered meaningful orientation to their grandchildren’s lives. Today, there’s no pause, you’ve got to keep going – stay agile – react quickly – better be proactive – ideally anticipate.

Failure to adjust to these new types of economies will severely limit the opportunities for near-term growth; and in the long run, it would jeopardise the health of the entire economy. There’s no real choice, you have to get onboard. The Digital Revolution gradually transforms the traditional physical economies, and the ultimate result will be radically different from what we’ve known so far: after the Digital Revolution, economies will run ‘predominantly non-physical’, with only rudimentary physical underpinnings.

The full impact of this transformation might be difficult to imagine, but some clear signals are visible already today. Take the automotive industry and the future of mobility as an illustrative example. Until about ten years ago, the idea of individual mobility was inescapably tied to the private car, and the big car manufacturers had to worry only about increasing their sales and market share. Today, newcomers from outside the automotive industry (think Google, Uber, or Tesla) have demonstrated viable alternatives to the traditional business models. These alternatives where unthinkable within the established industry. Still, their success exerts tremendous pressure on the traditional market incumbents, forcing them to seriously rethink their value propositions. It’s obvious that the big brands were caught off-guard by this unforeseen competition, but they now respond to the challenge and intensify their innovation efforts in order to defend their position, even if that means to –at least partially– redefining their market, their product, and themselves.

This need to respond to challenges and to adapt to unforeseen circumstances is inherent to information and knowledge economies, given their non-physical attributes and their speed. Consequently, such economies demand formidable problem-solving skills. As we transition through the Digital Revolution, innovation is more important than ever before. But where then should we focus our efforts to take advantage of the opportunities that arise and to promote necessary changes, while avoiding undesirable outcomes? Time to talk about the third axis of the economic space: the innovation targets.

The innovation targets

Jane Jacobs gave us the description of economies as complex adaptive systems. The three economic processes dominating these systems constantly compete over the limited resources available, over the economic fuels. Based on Jacobs’ concepts and what they can tell us about innovation, I’ll sketch an approach to focus our innovation efforts.

The three suggested innovation targets are neither carefully delineated, nor are they intended to be mutually exclusive. Instead, they should serve as a simple reference frame that helps us think about the flow of resources through our economy: How are the economic fuels connected to the economic processes? From the essential understanding of this resource flow, we can then address the pertinent questions: Do we have what we need? Does it get where it is needed? Let’s take a closer at the three innovation targets then: the supply, distribution and use of economic fuel.

Conventional growth policies today tend to focus on the use of economic fuel, promoting efficient use and discouraging waste of the available resources. Remember that these policies are devised for economies running on rival, excludable, hence costly resources, so this focus is entirely plausible.

The second facet of resource flow is the supply of economic fuel: What is the origin of the economic fuel used in an economy? What are the sources of the resources? Historically, growth policies have often favoured the expansion of resource supply by simple expropriation (consider forced labour and slavery, and take the Colonial Empires as cases in point). However, in today’s globalised world, such brute-force approaches are widely rejected for ethical and political reasons. Hence the potential expansion of resource supply is limited to rare opportunities:

- Such opportunities arise from the discovery of previously unknown deposits (for example mineral deposits on the ocean floor).

- Novel technological developments could give access to deposits that were known already, but beyond reach (think about hydraulic fracturing to extract shale gas).

- Extremely rare, but with the potential to transform the entire economy in the long run, is the advent of a new type of resource, like coal and steam in the past (during the Industrial Revolution) or information today (in the Digital Revolution).

As the bridge between fuel supply and fuel use, the distribution of economic fuel plays a pivotal role for any economy. Usually, distribution is simply understood as the transportation from the source to the user. But if you take into consideration the constant changes of available supplies and actual user demand, you will see a complex network emerge around the transportation and storage of economic fuel. This network must not only solve problems of location (where is a fuel supplied or used) and volume (how much of it); it must solve issues of time as well (by storing surplus fuel when the supply exceeds the users’ demand).

As an additional critical dimension, this network must ensure the transformation of economic fuel, for example turning coal (a material) into steam (a form of energy), or steam into electricity. Such transformations are no doubt important in our well-established physical economies. But they become truly indispensable in the transition to the information economy. If you keep in mind that any economy can only use those fuels that it is equipped for (the resources it can digest), it is obvious that entirely new fuels are indigestible, at least initially. However, the first economy that finds a way to make use of this new fuel will gain a massive, albeit temporary, advantage over its competitors: unrivalled access to an additional resource and the chance to unleash its full potential for future growth. Therefore, the distribution and especially the transformation of economic fuel presents a high-value target for our innovation efforts.

Taken together, the three axes framing the economic space (the economic processes, the economic fuels, and the innovation targets) facilitate the comprehensive analysis of economic health, of the strengths and weaknesses of a given economy.

Promoting sound policy making

Talking about economic narrow-mindedness, what really worries me is the widespread hope for simple solutions to complex problems, even the willingness to brush aside the complexity of the real economy, to follow simplistic abstractions and mono-causal explanations. The resulting policies are prone to failure, and they are likely to do more harm than good. Using the three dimensions of the economic space as a reference frame, you can see the potential flaws of overly simplistic approaches:

- Economic processes – If you were to commit all available resources on growth, you’d undercut the processes of economic self-maintenance and of innovation. Such a policy could result in the desired gain in the short-term, but it will definitely delay problem-solution (innovation) and cause new problems in the medium-term for self-maintenance. Therefore, growth should not be the singular focus of economic policy – growth must be seen in full context, as one of three parallel processes that compete for the same resources, but play out over different time-scales.

- Economic fuels – Different fuels have different characteristics, and they stand for different types of economies. If you were to focus on the physical economy alone (and the rival, excludable, depletable resources driving these economies), you would stay within the certainty of established business models and proven institutions. It’s actually quite tempting to avoid the uncertainty and novelty of the non-physical economies that are fuelled mainly (though not only) by information and knowledge. However, this is not an either-or decision. Rather, you’ll need to strike a sound balance between the physical economy (for that’s where you are coming from, and you will definitely need to retain a part of it in the future) and the non-physical economy (that’s where the biggest potential for future growth is). Your challenge is in defining a reasonable balance now and adjusting that balance over time. As the Digital Revolution pushes the transformation towards the non-physical economy, there is no static equilibrium you might pursue. Constant adaptation will be the norm, and adaptability will be key for successful economic policies.

- Innovation targets – Traditionally, you would focus your innovation efforts on the use of economic fuels, on increasing efficiency and reducing waste. But such optimisation approaches usually offer just a few percentage points of improvement. Instead, you might concentrate on the supply of economic fuels. However, the opportunities for supply increases are very rare. Therefore, the most promising innovation target is the distribution of economic fuel. You could promote logistics efficiency by optimising the transportation and storage of economic fuels. You could focus on traditional transformation and encourage the reduction of transformation steps, hence minimising the inevitable transformation losses. Or you could target novel transformation: developing the tools and processes to harness information and knowledge in a largely traditional economy, thereby building the foundation for the evolving non-physical information and knowledge economies and paving the way for the full exploitation of these (still) novel fuels.

Of course there are many more interconnections between the processes, fuels, and targets. As always, the devil is in the details. The descriptions above are too generic to offer concrete advice for any specific case, be that an entire national economy, an industry sector, or a corporation. But I do hope that the concepts I’ve layed out will help decision-makers to ask the right questions about the missing elements and the unintended consequences of draft policies, in order to ultimately arrive at better economic policies. Here’s a set of rewarding objectives to pursue: solving an economy’s immediate problems, ensuring its self-maintenance, and promoting its long-term sustainability and health.

I need to get this Jane Jacobs book.

My question though is who are these “decision makers”? Is this even really something which is decided? Or does it emerge in a decentralized fashion from the actions, goals, compromises and so forth of millions?

Very good point. What I had in mind are formal policy decisions, drafted, written, approved, and put into force. That happens top-down. You add an important facet to economic decision making: the choices made by the millions, which is bottom-up, decentralised, emerging. Those choices – every day as customers, and every four years (or so) as voters – are taken individually of course, but their collective outcome has tremendous impact on the future course of the economy. In that sense, we all take part in economic decision-making. That in turn has an influence on formal policy-making. We might even go as far as considering the collective result of individual choices as something like implicit or unspoken policy. That’s an interesting idea.